Commercial Investment

![]()

|

|

|

|

Terms & conditions | Privacy statement | Disclaimer | Code of practice | Contact Us | About Us

27-30 Lime Street

27-30 Lime Street

LONDON EC3

Long Leasehold Office Refurbishment Opportunity with some Retail Income

Executive Summary

• 27-30 Lime Street is in a core office and retail location within the EC3 postal district of the City of London, which is dominated by the insurance market.

•

The property provides approximately 743 sq m (8,000 sq ft) of retail and office accommodation, arranged on two basement levels, ground and four upper floors.•

The property is held on a long lease, expiring in September 2149, at an effective gearing of 5% of rents received, less deductible expenses as defined in the headlease.There is a minimum ground rent of 2.5% of the average rent over the preceding five years, reviewed every fifth year. The initial rent was £6,598.10 pa and the September 2004 rent review is still outstanding.

•

• The office accommodation on 1st to 4th floors of 658 sq m (7,084 sq ft) is effectively empty and available to refurbish prior to reletting.

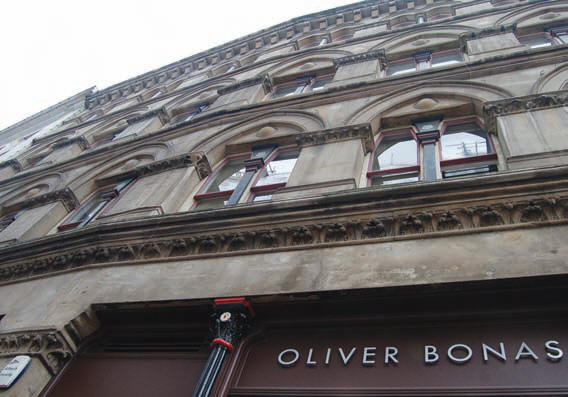

• The two retail units are let to Coral Estates Ltd until March 2010 and Oliver Bonas Ltd until June 2017, at a total rent of £107,500 per annum. This averages c. £1,938 per sq m (£180 per sq ft) ITZA.

The public house is let until 2110 at a peppercorn rent.

• We are instructed to seek offers of £4.15 million, subject to contract and exclusive of VAT, for the long leasehold interest. This could be split as follows: Retail Income: £1.65m - 5.85% NIY. Vacant Offices: £2.5m - £3800 per sq m (£353 per sq ft).

LOCATION

27-30 Lime Street is located within the heart of the insurance district of the City of London. It is on the south east side of the street, approximately 50 metres south of the Lloyds of London building.

The surrounding area is dominated by leading international companies within the insurance, professional and financial industries as well as world class institutions such as Lloyds of London and the London Underwriting Centre.

Nearby occupiers include Royal and Sun Alliance, Swiss Re Insurance Co UK Ltd, Willis Ltd, Exel Re Europe Ltd, Commerz Bank, Moody’s Investor Service Ltd, Accenture, Clyde and Co and Holman Fenwick and Willan.

Leadenhall Market is within a few metres and this

Tenant Profiles

Coral Estates Ltd

Private limited company incorporated 13 June 1962. Coral Estates Ltd is a real estate management arm of the Gala Coral Group Ltd.

Coral was established in 1926 and operates 1,267 licensed betting shops throughout the UK as well as a telephone betting operation, greyhound racing stadia at Brighton & Hove and Romford and an online betting business, www.coral.co.uk. Coral also operates an online casino, gaming site and poker site. In 1997 it acquired Eurobet, the international gaming operator, from Bass for £362m.

Eurobet has customers in over 100 countries and offers betting services in 18 different languages. In September 2002 Charterhouse Capital Partners backed the management team to acquire Gala Coral for £860m. In October 2005 Coral Eurobet announced that it had been formally acquired by the Gala Group for £2.18bn.

For the year to September 2006, the sales turnover was £31.95m, with a loss of £2.2m and a tangible net worth of £11.1m.

The Dun & Bradstreet rating is 3A1 which represents a minimum risk of business failure.

Oliver Bonas Limited

Private limited company incorporated 1 July 1999. Oliver Bonas Ltd have nineteen stores in London and its environs together with an online operation, www.oliverbonas.com. They sell unique gift ideas, wedding gifts, baby gifts, fashion accessories, jewellery and novelty gifts. Oliver Bonas were “Multiple Retailer of Gifts Winner” in the Greats Gift Retailer Awards 2007. Their head office is in Chessington, Surrey. For the year to December 2006, the company had a tangible net worth of £453,000. The Dun & Bradstreet rating is A3 which represents a greater than average risk of business failure.

Planning

27 Lime Street is Grade II Listed; 28-30 are not. All the buildings are situated within the Leadenhall Market Conservation Area. There are no relevant recent planning applications recorded for the properties.

Please Contact PL2L for more info on:

Schedule of Tenancies and Accommodation - The Royal Arcade, Norwich

|

|

|

|

|