Commercial Investment

![]()

|

|

|

|

Terms & conditions | Privacy statement | Disclaimer | Code of practice | Contact Us | About Us

205.jpg)

207.jpg)

Retail banking and office sale and leaseback opportunity on

the instructions of Barclays Bank

Proposal

We look to seek offers in excess of

£5,650,000 (five million six hundred and fifty thousand pounds) subject to contract for the freehold interest in the property. A purchase at this level will attract an attractive net initial yield of 7.4% after purchaser’s costs of 4.25%.We are not retained and would require a fee to be agreed further information is available

on receipt of a Letter of Interest and a signed Fee agreement.

Executive Summary

• Prominent retail bank and offices in a landmark location.

• The properties will be leased back by way of two separate

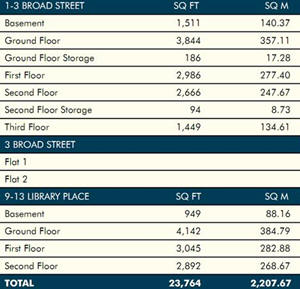

24 year leases to Barclays Bank Plc. The lease of 9-13 Library Place will have a tenant’s break option at the end of the 15th year of the term. The lease of 1-3 Broad Street will have a tenant’s break option at the end of the 5th year of the term and 5 yearly thereafter.• The property provides 23,764 sq ft (2,207.67 sq m) of office accommodation predominantly arranged over ground and three upper floors.

• The initial rent will be £436,227 per annum. The leases will have the benefit of fixed rental increases of 2% per annum for the rent reviews at years 3 and 6.

• Subject to planning there is good redevelopment potential upon lease expiry.

• Offers are sought in excess of

£5,650,000 (five million six hundred and fifty thousand pounds) which reflects a net initial yield of 7.4% after usual purchaser’s costs of 4.25%.

Location

J

Jersey is the largest of the four Channel Islands, covering an area of approximately 44 square miles and lying 160km (100 miles) south of the coast of England and 20km (14 miles) west of the coast of Normandy, France.The Island is served by regular sea and air links to both the United Kingdom and the Continent. Regular air services are provided to

London Gatwick, London City and Southampton airports and a fast ferry service has daily sailings to Weymouth, Poole and St Malo and a freight service to Portsmouth.

Jersey is a Crown Dependency; it is not part of the UK, nor is it a colony but it does owe its allegiance to the British Crown and the UK is responsible for Jersey’s defence and international representation.

Jersey is not represented in the UK Parliament. The legislation of the Island is called “The States of Jersey”, members of which are elected by the population. St Helier is the Island’s capital and the main town.

Local Economy

Jersey is a prosperous island with a stable, strong and successful economy and a high standard of living. The Island has a population of circa 90,800. The economy is dominated by a high quality financial services industry which contributes to more than 60% of the GDP and employs more than 28% of the working population. The principal catalyst of this successful finance industry is the Island’s exemption from the UK tax regime.

The favourable tax climate has attracted 47 banks from the UK, Europe, North America, Middle East, Far East and Asia. Between 2000 and 2008 total bank deposits held in Jersey increased by almost £80 billion.

Bank deposits currently stand at approximately £197 billion, with total value of funds administered of £240 billion and a total number of funds currently standing at 1,452 comprising 3,080 separate investment pools. Aside from banking, the next major income generator is tourism which provides around 24% of GDP.

The total visitor volume is approximately 740,000 people per year, with approximately 80% of the income from the UK.

Situation

The property occupies a prominent location in the heart of St Helier’s central business district, benefiting from close proximity to the prime pedestrian retail areas of St Helier, and the Esplanade, which is fast becoming the Island’s main business district.

The Broad Street and Library Place areas of St Helier are close to the traditional heart of St Helier, namely the Royal Square and States Chambers, and are considered to be one of the prime office locations, with nearby occupiers including Lloyds TSB, Royal Bank of Canada, NatWest and HSBC Bank.

Description

The property occupies a prominent landmark corner location and in majority has very attractive period facades. The property comprises two buildings, namely 9-13 Library Place and 1-3 Broad Street.

Barclays originally acquired Library Place in the early 1920’s and at this time 1-3 Broad Street was the British Hotel. 9-13 Library Place was rebuilt in 1969 and the buildings were combined into their current configuration in the mid 1980’s.

The buildings are predominantly built over ground and three upper floors and are of traditional masonry construction under a mixture of pitched slate and flat mineral felt covered roofs.

The property provides accommodation for retail banking at ground floor level and a range of open plan and cellular office accommodation on the upper floors.

The specification of the offices is similar throughout and generally includes comfort cooling and heating, suspended ceilings with recessed lighting and perimeter trunking for IT and power distribution.

The Office Market in St Helier

The office stock in Jersey is currently approximately 2.5 million sq ft.

Vacancy rates in St Helier are historically low and currently stand at approximately 5%. The market is predominantly driven by the financial institutions.

Recently the States of Jersey has sought to consolidate the office market around the Waterfront and Esplanade areas.

Broadly speaking, Jersey has had a three tier office market, with prime head-line rentals of £30.00 per sq ft having been achieved.

In the more secondary market, rents are between £20.00 per sq ft and £22.00 per sq ft. Despite the global economic conditions office rentals have been reasonably robust and there is currently no evidence of rental levels having fallen.

PLEASE CONTACT US AT PL2L FOR MORE INFORMATION

|

|

|

|

|